Tax / Utilities Collector

Tax Collector

Lisa Eggert

Tax Clerk

Nancy Shendock-Rohloff

HOURS

Monday – 8:30 p.m. – 4:30 p.m.

Phone: (856) 768 – 2300, Ext. 271

Fax: (856) 306 – 0147

EMAIL: tax@waterfordtwp.org

Attention Veterans, If you are an honorably discharged veteran with active-duty military service, you may qualify for an annual $250 Property Tax Deduction. Please click the link below:

Click the button below to pay your taxes / utilities online

Please be advised that when you enter a payment in the system your checking account or credit card will be charged that day. All items returned to us as non-payable will be assessed a $20 fee.

Tax / Utility PaymentProperty Taxes

Property taxes in New Jersey are due quarterly, February 1, May 1, August 1 and November 1. There is a 10-day courtesy grace period. A payment may be made before the due date; however, if a payment is not received within the grace period, interest is calculated from the date the payment is originally due. Post marks are not accepted and payments left in the outside drop box after 4:30 p.m. on the 10th will be processed the next business day and will be subject to interest calculated from the due date.

State law mandates that any payment that is late is subject to interest charges. Amounts up to $1,500 are charged 8% interest. Once a delinquency over $1,500 exists, 18% interest remains until the account is brought current. Additionally, there is a provision for a year end penalty of 6% for any property that owes municipal charges of $10,000 or more on December 31st.

Property taxes, utility charges and any other municipal charges are assessed on the property itself. Annually, (June/July) a tax rate is struck. New tax bills are then produced. They are for the 3rd and 4th quarter of the current year and the 1st and 2nd quarter of the next year, based on the new rate. If you have a mortgage company that escrows for your taxes, they will receive a tax bill and an advice copy will be sent to the property owner. Original bills will be sent to those owners who do not have a mortgage company. The State takes the position that taxes are assessed on the property, and it is the responsibility of the current property owner to pay the taxes regardless of the receipt of a tax bill.

Added/Omitted Assessment

Added/Omitted tax bills go out in October and are due on November 1st. These billing amounts are added to the original billing for the current year 4th quarter as well as the 1st and 2nd quarter of the following year. These will be combined the following year.

Assessment Appeal

Contact the Tax Assessor’s Office at (856) 768-2300 x 207 and see the assessor’s web page for information.

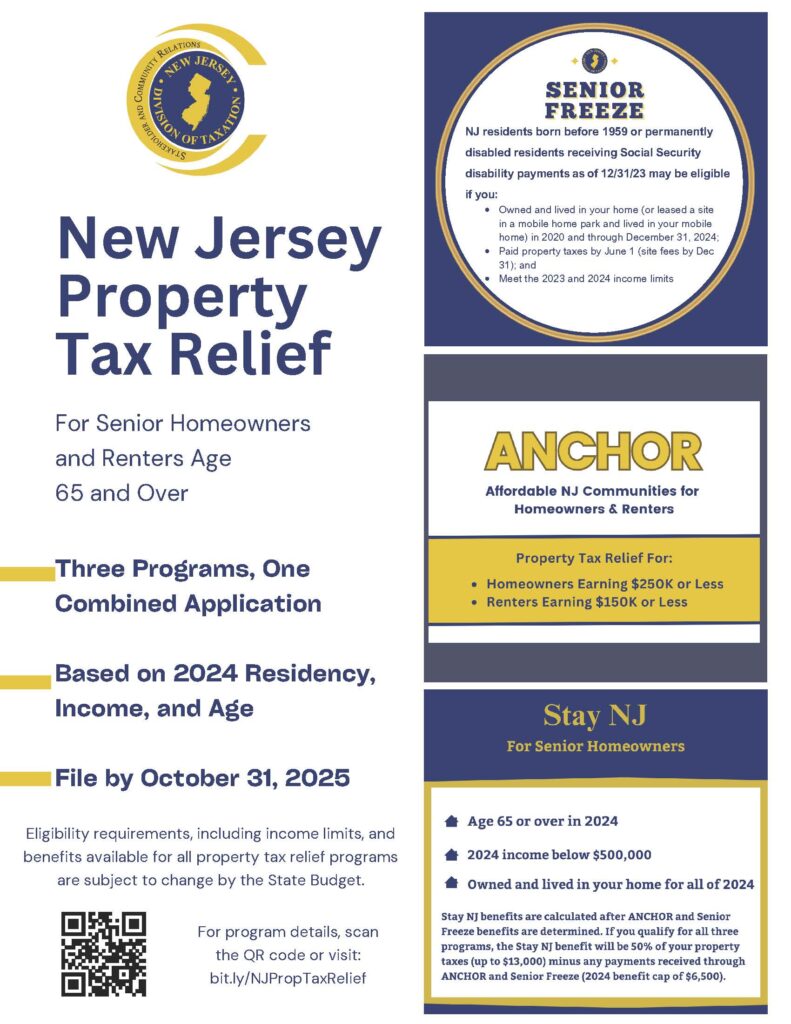

Property Tax Relief Programs

Please see the Tax Assessor’s site to obtain information on available programs offered by the State of New Jersey.

Tax Sale

NJ statute requires all municipalities to hold a Tax Sale annually. When there are unpaid balances from municipal, county or state charges, i.e. taxes, property maintenance, Waterford Township Utilities or Camden County Municipal Utility Authority (CCMUA) from the preceding year, the property is included in the Tax Sale. The date of the Tax Sale is determined by the Tax Collector and will be advertised on the township website and in The Central Record. If you are going to tax sale, you will have notices sent to the address we have listed in our most current tax duplicate.

Method of Payment

Payments can be made to Waterford Township Tax Collector by mail or in person during normal office hours by check or cash. Credit and debit cards are accepted online only. WE DO NOT TAKE PAYMENTS BY PHONE.

For your convenience, we have an afterhours mailbox located outside on the side of the front vestibule of the municipal building. If you would like a receipt, please include a self-addressed stamped envelope with your payment. Please do not put cash in the drop box. Payments left after normal business hours will be processed the next business day and may be subject to interest if it is after the grace period.

Mailing Address Change

Any changes in address must be done in writing. You may also email it to us at the link provided or fax it to us at 856-306-0147.

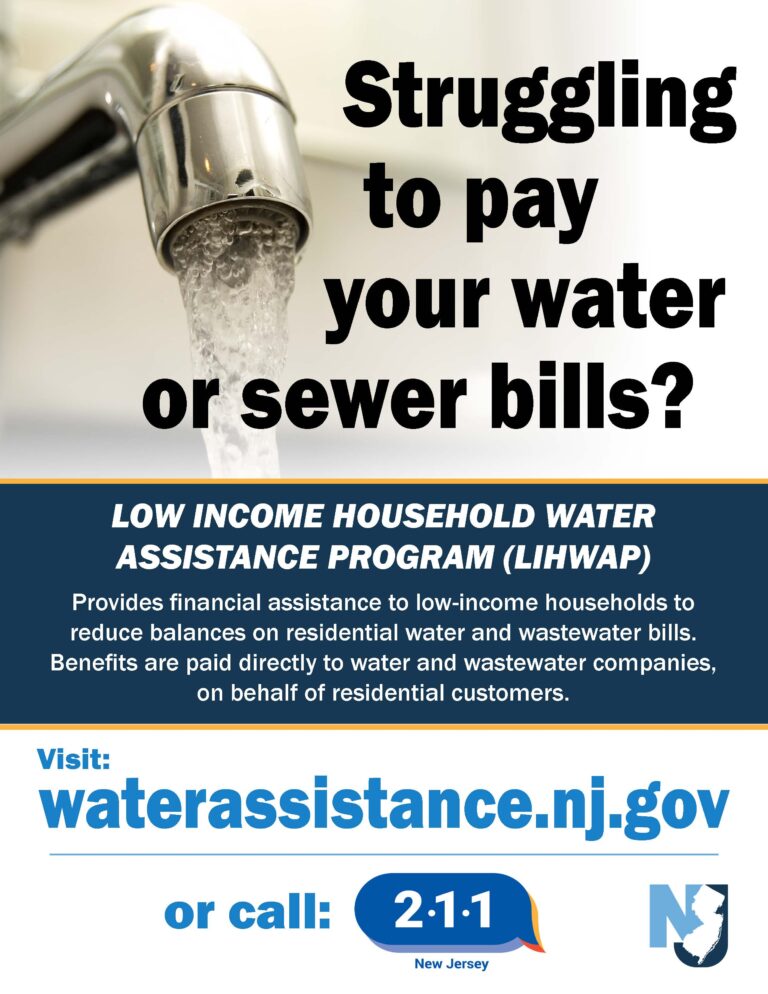

Utility Information

The Tax Collector is responsible for receiving utility (water/sewer) payments. Billing is calculated on a quarterly basis, January 1st, April 1st, July 1st and October 1st. Water is billed for the prior 3 months usage and sewer is billed for the next three months. Payments are due on or before the 30th day of the month that is billed. If payment is not received by the 30th day, interest is calculated at 18% interest and will be charged back to the billing date. Water and sewer rates can be found on your bill. Please be advised that all properties in Camden County connected to the public sewer system receive two sewer bills. One is from the Township and one from the CCMUA. You can reach the CCMUA at 856-541-3700.

Payments can be made by mail with a check or money order, in person with check, cash or money order. You can also pay online with check, credit or debit card. We do not take payments over the phone. Checks are to be made payable to Waterford Township Utility and your account number must be on the check. They can be mailed to Waterford Township Utility, 2131 Auburn Avenue, Atco, NJ 08004.

If payment is not received we will send out a shut-off notice. Once a shut-off notice is sent, we will no longer take a personal check. Payment will have to be made with cash, certified check or money order. There will be a $40 turn off/on fee assessed. Your entire balance must be paid by noon to have water turned back on. Water is only turned on between the hours of 2:00 p.m. and 3:30 p.m.

Final Reads – If a property is selling, our office must be contacted at least three days prior to arrange for a final read. There is a $25 charge for the final read and name change. It is the property owner’s responsibility to inform us if they buy, sell or change their address. It is also their responsibility to make payment whether a bill is received or not.

The annual water quality report can be found at: annual report.

Permits for new water and sewer connections – You must contact the Public Works Department at 856-767-2359 for connection permits.

2131 Auburn Avenue

Atco, NJ 08004

Phone: (856) 768-2300

Hours: Monday – Friday 8:30 a.m. to 4:30 p.m.